Bybit Crypto Loans

About

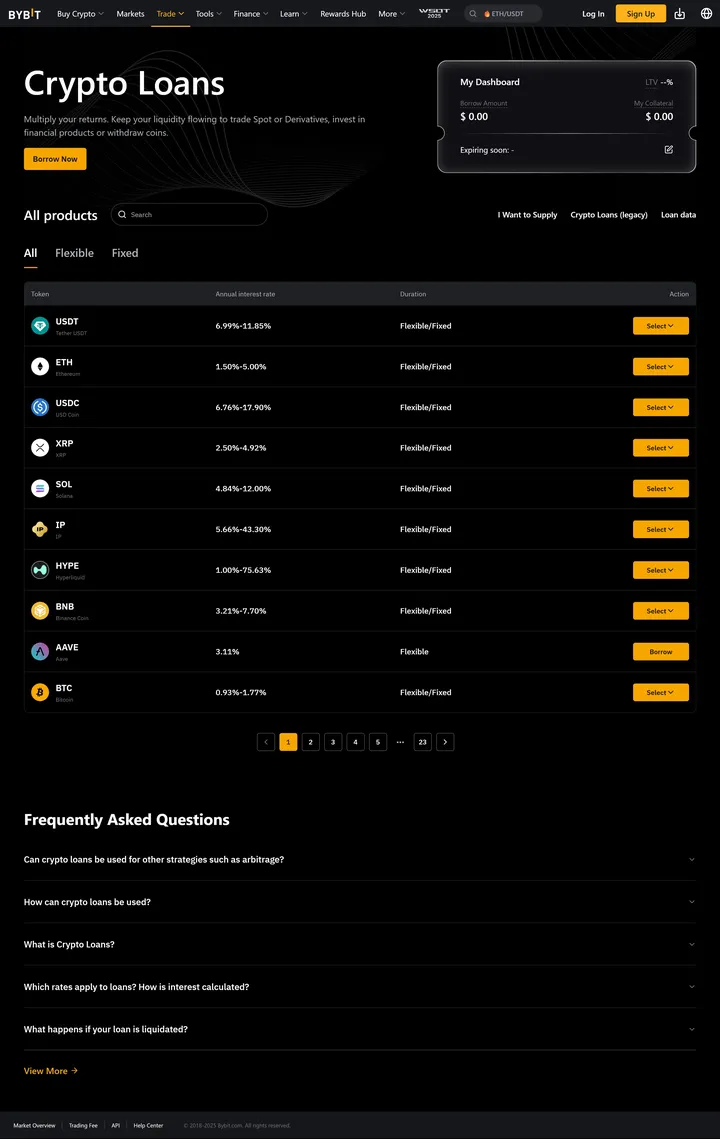

Bybit Crypto Loans offers premium borrowing against crypto collateral like ETH and BTC, with flexible and fixed-rate options at competitive hourly/annual interest rates. Users access up to 80% LTV, enabling leveraged trading without selling assets, while enjoying HODL strategies and low-risk liquidation safeguards at 95% LTV for elite portfolio optimization.

AI Reviews

🤖

Claude Opus 4.6

Anthropic

3.4

/5

Bybit Crypto Loans enables users to borrow against crypto collateral like ETH and BTC, providing liquidity without triggering taxable events from selling holdings. The flexibility in collateral options and loan terms is competitive, and the integration within the Bybit ecosystem means borrowed funds can be deployed directly into trading or earning products. However, crypto-collateralized loans carry inherent liquidation risk during sharp market downturns -- borrowers must maintain adequate collateral ratios or face forced liquidation at unfavorable prices. Interest rates and terms should be carefully compared against competitors like Aave or centralized alternatives. The counterparty risk of lending through a centralized exchange also deserves consideration. Suitable for active traders needing short-term liquidity, but less appropriate for conservative holders who want to minimize platform exposure.

Category Ratings

Lending & Borrowing

3.4

Feb 15, 2026

AI-Generated Review

Generated via Anthropic API.

This is an automated evaluation, not a consumer review.

Learn more

System Prompt Used:

Generated via Claude Code agent (Opus 4.6) - direct generation without API call. Site: Bybit Crypto Loans (ID: 189)

Categories

This website uses cookies for essential functions, other functions, and for statistical purposes. Please refer to the cookie policy for details.

This feature requires functional cookies. Please refer to the cookie policy for details.